We’re very proud to announce that we will be releasing CoinGecko Derivatives, our brand-new Derivatives section featuring vital metrics for derivatives products such as perpetual swaps and futures. As a leading cryptocurrency data aggregator, we feel that this is a natural step forward in our mission to empower cryptocurrency traders with even more actionable data. Our aim is simple: to create the largest database for derivatives products in the crypto space.

In traditional financial markets, the derivatives market is huge, with the total notional amounts outstanding for contracts estimated at over $500 trillion (source). To put into perspective how much money that is, the Gross Domestic Product (GDP) of the United States in 2017 was $19.4 trillion (source).

Here at CoinGecko, we’ve made it our mission to democratize access to crypto data and we believe that the derivatives market holds tremendous potential. With that in mind, we’ve created our Derivatives section, which will become an invaluable tool for traders worldwide.

Currently, CoinGecko’s Derivatives section will have 3 main sections:

- Derivatives Product Overview: https://www.coingecko.com/en/derivatives

- Derivatives Exchanges Overview: https://www.coingecko.com/en/exchanges/derivatives

- Derivatives Exchanges Profile (e.g., BitMEX): https://www.coingecko.com/en/exchanges/bitmex

Overview

Let’s start with an overview of the entire crypto derivatives market:

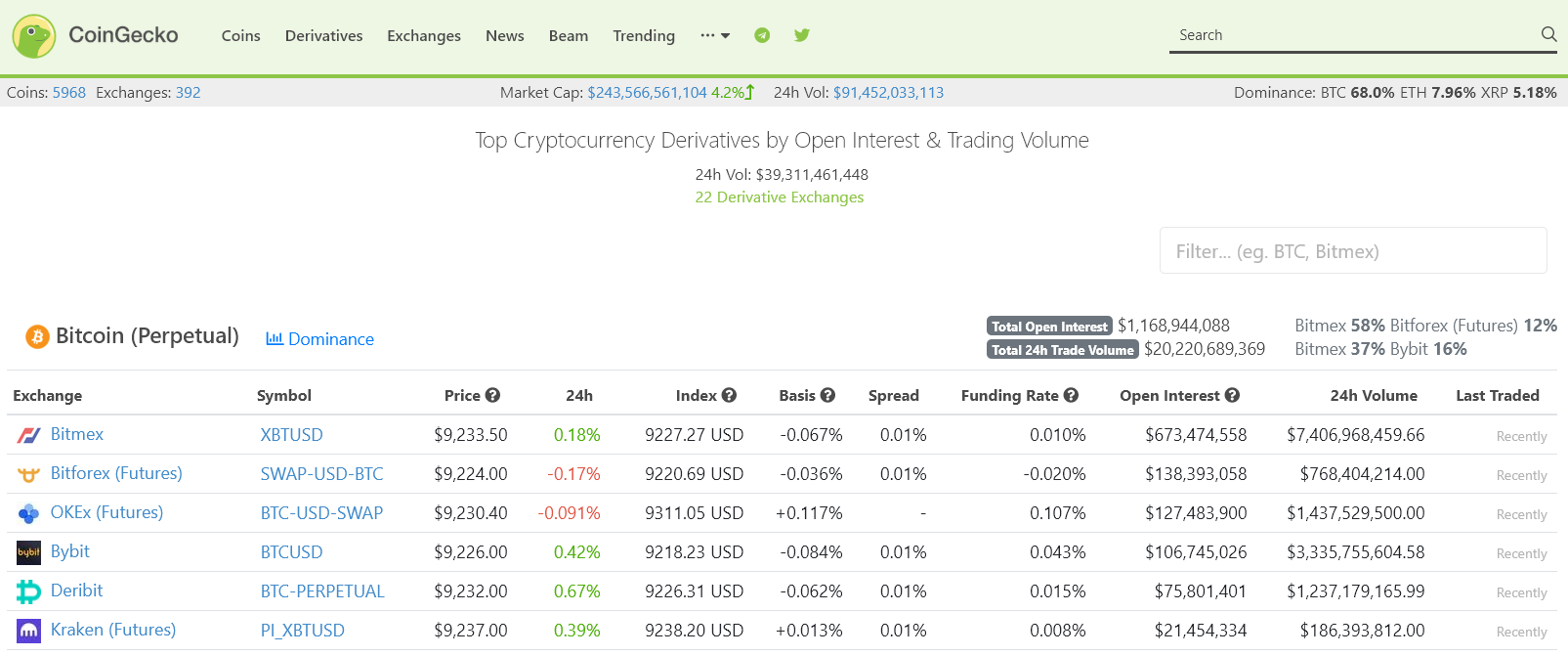

Derivatives overview page

Derivatives overview page

On this page, you’ll be able to see a list of all cryptocurrency derivatives products, first segregated by product type (perpetual swaps, futures, and options – coming soon), and then sorted by open interest and trading volume. We aggregated all the data that we think will help you make your next move. From left to right, you’ll see the following:

- Exchange – Where the contract is traded

- Price – The last traded price of the contract

- 24h – The price change in the last 24 hours

- Index – The index price as defined by a derivatives exchange for a given cryptocurrency (e.g., BTC)

- Basis – The price difference between the index price and the derivatives contract price

- Spread – The difference between the highest bid and the lowest ask

- Funding Rate – This is used to peg perpetual contract prices with spot prices. Positive funding rates refer to long contract holders paying short contract holders. Negative funding rates refer to short contract holders paying long contract holders. (Applicable only for perpetual swap products.)

- Open Interest – This represents the total number of outstanding derivatives contracts that have not been settled.

- 24h Volume – Rolling 24-hour trading volume for a given contract.

We think that this will be useful for any derivatives trader looking for an overview of the markets at a glance, without the need to browse multiple exchange websites to compare.

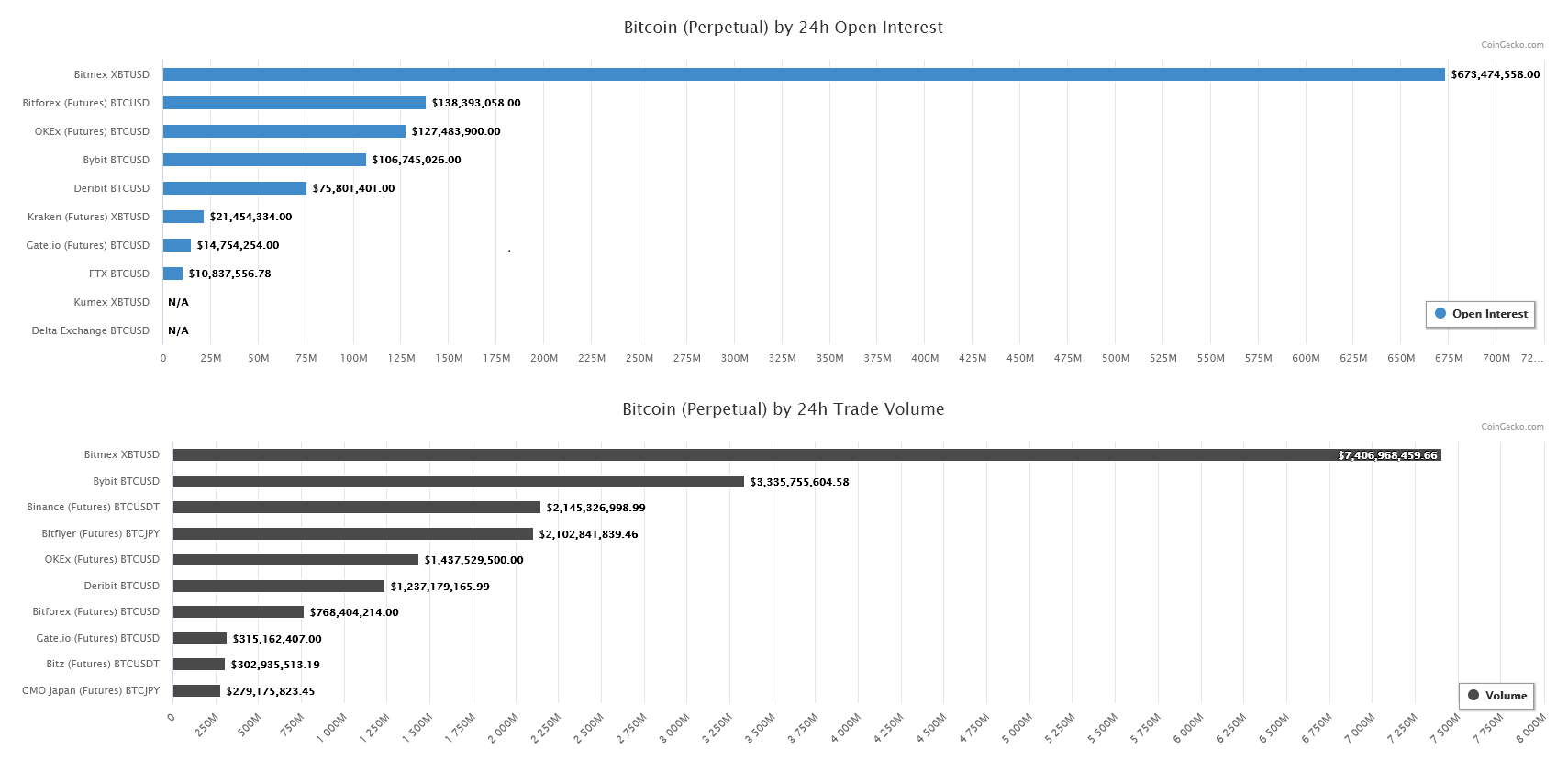

We’ve also put together a handy little chart for you to quickly compare dominance in terms of open interest and trading volume of each product – click on the blue dominance button to see it!

Open interest & trading volume overview chart

Open interest & trading volume overview chart

Derivatives Exchange Overview

Next we’ll take a look at the exchange overview page:

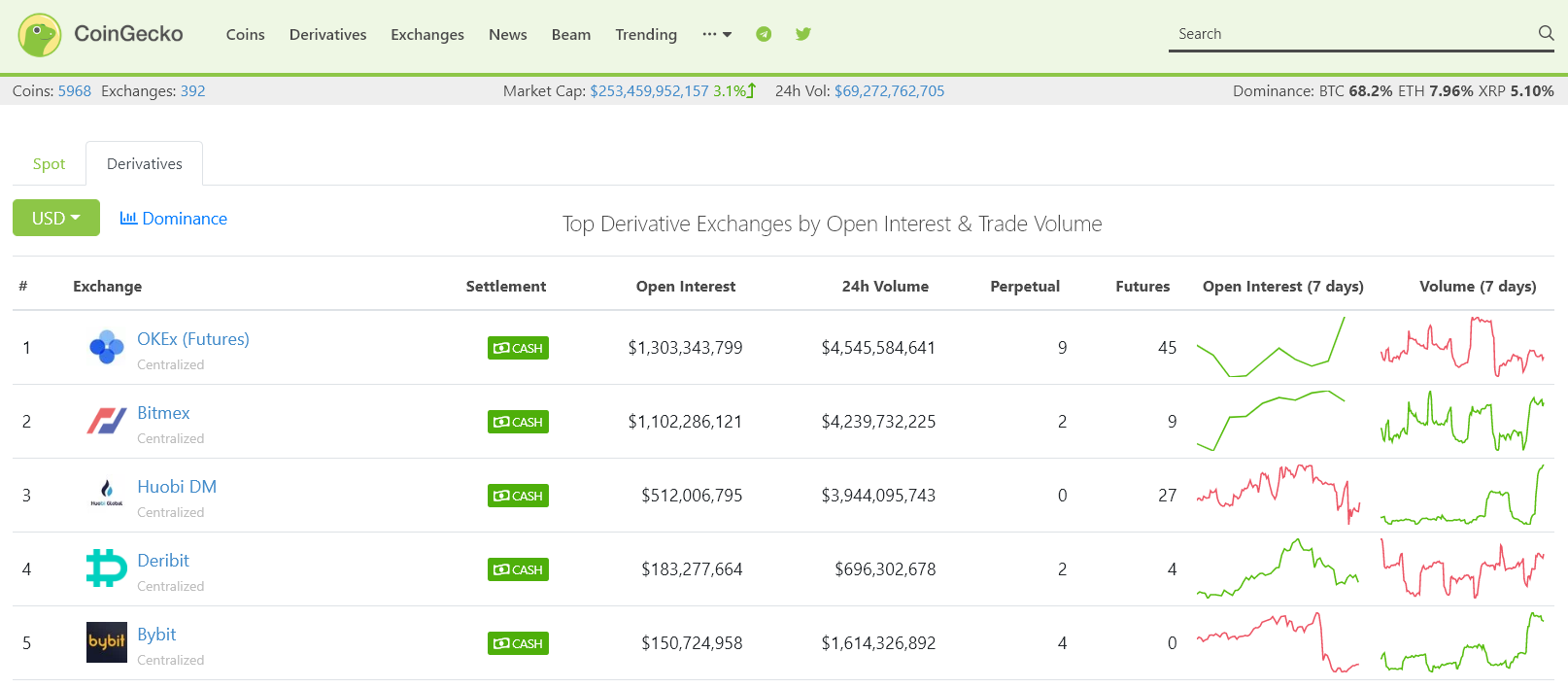

Derivatives exchange overview

Derivatives exchange overview

Much like exchange pages, you’ll see an aggregated view of all derivatives exchanges in one table, sorted by open interest. We have also put together some other information vital for an exchange’s overview:

- Settlement – Cash/Physical

- Open Interest/Volume – as explained above

- Perpetual/Futures – number of trading pairs by product type

- 7-day Graph of Open Interest & Volume – 7-day trend graphs

- Dominance Chart (next to currency selection) – A quick overview comparing open interest and trading volume amongst derivative exchanges

Individual Derivatives Exchange Profile

Finally, we’ll take a look at the profile page for each individual exchange:

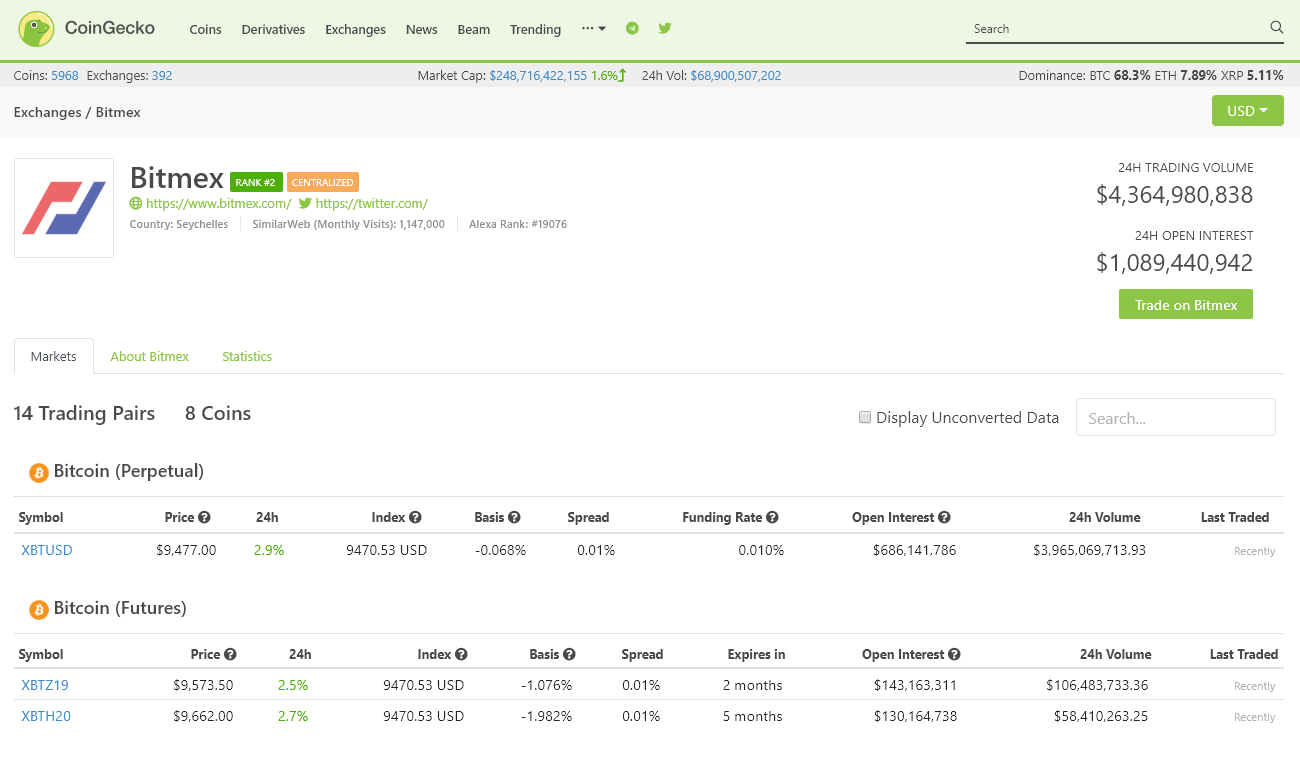

Derivative exchange profile page

Derivative exchange profile page

For each exchange, we display all trading pairs offered, segregated by product type (perpetual/futures/options), along with relevant details in a tabulated format. Traders will be able to quickly compare all contract pairs on an exchange on CoinGecko through key metrics such as open interest and trading volume.

Bonus: CoinGecko’s Derivatives 101 Guide

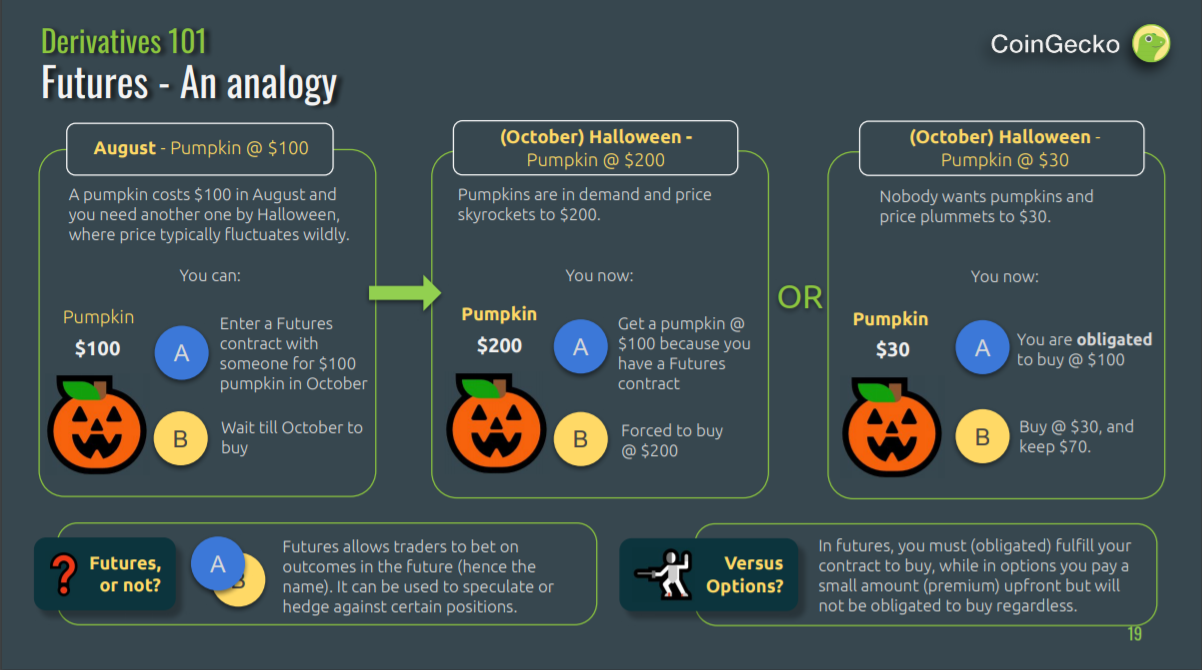

Do you have a friend who isn’t sure what derivatives are? Fret not. We’ve prepared just the thing for your friend, and you can easily share it. Enter CoinGecko’s “Derivatives 101”, published as part of our Q3 2019 Cryptocurrency Report (pages 15-22). This will help you easily grasp the concept through the use of spooky analogies, just in time for Halloween! A sneak peek for you:

Getting that Halloween groove on!

Getting that Halloween groove on!

We made this for folks who are unfamiliar with derivatives, so we hope it’ll be helpful to you or a friend as you journey toward understanding the complex world of derivatives!

Closing Remarks

The derivatives market is up-and-coming, and here at CoinGecko, we’re ready for whatever comes along! We’ll be ready to present to you the most relevant data, as well as to power you with data that you will need to BUIDL your application!

Moving forward, we will continue iterating and improving on our datasets to increase the breadth and depth of data that is covered on-site. Our derivatives data will soon be made available on our mobile app as well as on our free public API.

The post CoinGecko Releases Derivatives Section appeared first on CoinGecko Blog.