Flare Finance — Peeling Back The First Layers

In this document we will discuss the token distribution, product suite, profit generating mechanisms and governance staking incentives implemented into the Flare Finance Ecosystem. This will include an overview of the following topics:

- Token Distribution

- Product Suite and Ecosystem Map

- FlareX

- FlareFarm

- FlareWrap

- FlareLoans

- FlareMutual

- FlareMine

- APY Cloud

- ESB Distributions Protocol

- Excess Distributions

- Stressed Distributions

- Bond Distributions

Token Distribution

110,000,000 YFLR

Total Supply

The max supply of YieldFlare (YFLR) issued by the Flare Finance Foundation is 110,000,000. There is no minting implemented into the contract by default for security purposes. Burning is added as an optional feature that can be activated via governance, but is not readily available for use for security purposes.

40,000,000 YFLR

DAO Offering

40,000,000 YFLR issued by the Flare Finance Foundation will be distributed via DAO Offering to the public holders of $DFLR, our DAO Claim Token. A “DAO Offering” is a free public claim process where holders of $FLR will receive DAOFlare, or $DFLR, by airdrop automatically to the wallet address containing their $FLR at the time of the $FLR Snapshot. $DFLR holders will swap their $DFLR for $YFLR on platform after reading and agreeing to a few tutorials and terms/conditions. Any unclaimed $YFLR is removed from circulation and placed into the APY Cloud.

40,000,000 YFLR

Pool Mining

40,000,000 YFLR issued by the Flare Finance Foundation will be distributed via “Pool Mining” from the APY Cloud to the participants of on-platform Governance Staking. This 40,000,000 YFLR is only distributed based on the terms voted by holders to be established by the APY Cloud. This rewards pool would provide yield for 3 years during a period of low usage, and in optimum conditions, would sustain permanently with APY Cloud.

10,000,000 YFLR

Team and Investors

10,000,000 YFLR issued by the Flare Finance Foundation will be allocated to the Team and Investors of Flare Finance, the for-profit development corporation designated to maintain the core code of the Flare Finance Ecosystem and respond to the Foundation Paid Governance Requests submitted by the Flare Finance Foundation. This 10,000,000 YFLR is vested in 12 parts, one part released each month, over the vesting period.

10,000,000 YFLR

Foundation

10,000,000 YFLR is held by the Flare Finance Foundation, the non-profit foundation that owns the code and ecosystem as a whole. The Foundation is user-governed through smart contracts. These governance decisions are reviewed and carried out by the Foundation itself. The 10,000,000 YFLR is utilized for operations, salaries, grants, and other necessities to help maintain the ecosystem’s growth and sustainability.

10,000,000 YFLR

Reserves

10,000,000 YFLR is held by the Flare Finance Foundation in the “Community Reserve Pool’’. This pool is to be utilized for user-governed proposals specifically submitted on FlareGovernance. This can be for any number of reasons including; paying third-party developers for code maintenance, providing grants for community developers to create new applications and products, covering user requested marketing costs, token burning to reduce supply, and more. The Community Reserve Pool gives the people a “No Strings Attached” means of utilizing reserve tokens in their ecosystem.

11,000 YFIN

Total Supply

The max supply of YieldFin (YFIN) issued by the Flare Finance Foundation is 11,000. There is no minting implemented into the contract by default for security purposes. Burning is added as an optional feature that can be activated via governance, but is not readily available for use for security purposes.

8,000 YFIN

FlareFarm Distributions

8,000 YFIN is mined through participation in yield farming on FlareFarm over 3 years. Yield Farming can be conducted by participating in either single or dual-coin LP Pool Staking. The distribution schedule is as follows: Year 1–4,000 YFIN, Year 2–2,000 YFIN, Year 3–2,000 YFIN.

1,000 YFIN

FlareMutual Distributions

1,000 YFIN is distributed through participating in providing coverage liquidity to the mutual fund for use in the event of a coverage claim. YFIN supplements platform APY generated through coverage purchases and other fee based earnings on FlareMutual. The distribution schedule is as follows: Year 1–500 YFIN, Year 2–250 YFIN, Year 3–250 YFIN.

1,000 YFIN

FlareLoans Distributions

1,000 YFIN is distributed through participating in providing liquidity to the loan pool to be borrowed within our ecosystem. YFIN supplements platform APY generated through loan payments and other fee based earnings on FlareLoan. The distribution schedule is as follows: Year 1–500 YFIN, Year 2–250 YFIN, Year 3–250 YFIN.

1,000 YFIN

Reserves

1,000 YFIN is held by the Flare Finance Foundation in the “Community Reserve Pool’’. This pool is to be utilized for user-governed proposals specifically submitted on FlareGovernance. This can be for any number of reasons including; paying third-party developers for code maintenance, providing grants for community developers to create new applications and products, covering user requested marketing costs, token burning to reduce supply, and more. The Community Reserve Pool gives the people a “No Strings Attached” means of utilizing reserve tokens in their ecosystem.

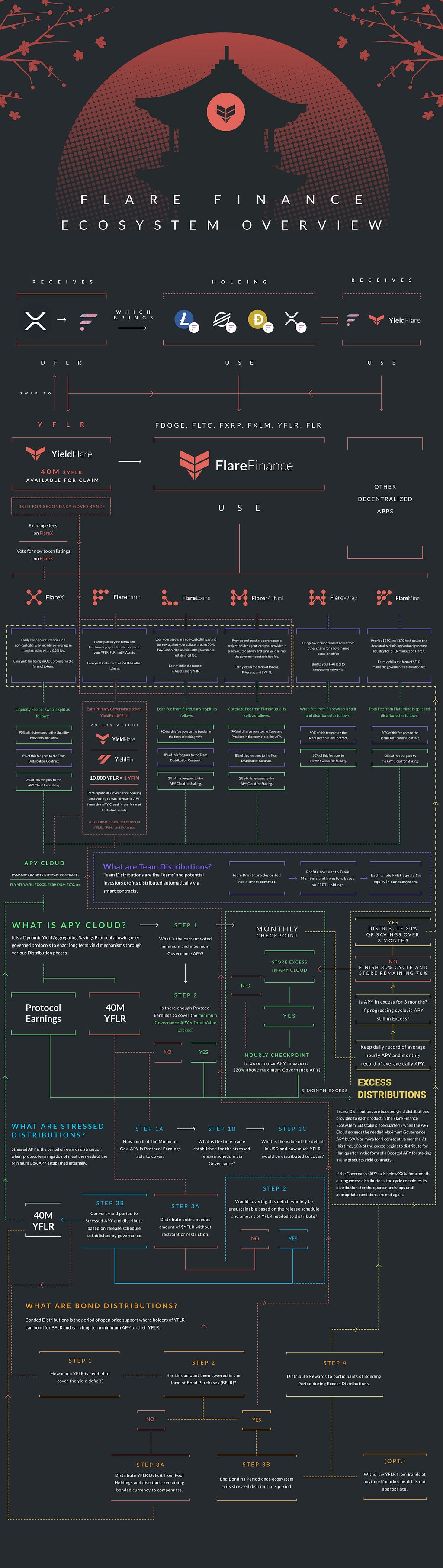

Product Suite and Ecosystem Map

Flare Finance is a 6 product ecosystem that implements several different long-term yield aggregating savings mechanisms within all 6 products creating the first institutional grade decentralized finance platform with endless value potential. This is all thanks to a yield aggregating savings protocol called the APY Cloud. The Flare Finance Ecosystem utilizes all of the major F-Assets birthed in the Flare Network as well as the ecosystems main platform tokens; YFLR and YFIN. Profits from each platform are collected from each transaction in the form of the tokens being utilized. These profits are distributed back to Yield Pools which makeup the APY Cloud, and the Team Distributions Contracts. In this topic we will discuss how profits are distributed back to the yield pools for each product, as well as the APY Cloud. Below is a visual representation of monetary flow in the ecosystem.

FlareX

FlareX is the ecosystem’s decentralized spot and margin trading platform. The platform allows traders to swap or leverage various tokens trustlessly in a non-custodial manner.

FlareX utilizes immutable smart contracts to provide automated market makers (AMMs) with liquidity utilizing a specialized dynamic curve implemented to mimic real-world market conditions as closely as possible. Participants of the ecosystem can become On-Demand Liquidity Providers and earn fees for doing so in the form of a boosted liquidity pool position. Users of FlareX can swap or leverage their tokens easily with our user-friendly interface for a variable fee per transaction established via user governance. This fee is divided in 3 ways:

90% of this fee is distributed back to the liquidity providers.

8% of this fee is distributed to the Team and Investors Pool.

2% of this fee is distributed to the APY Cloud for Governance Staking Rewards.

Providing liquidity is a great way to earn long-term stable yield on your assets and allows holders in the ecosystem to become the liquidity providers to the traders themselves. New token pairings are voted on by these holders and allows for a fully user-governed trading experience full of the tokens people love to trade. $YFLR plays a heavy part in this piece of our ecosystem, allowing the holder to use it for trading fees or to vote on the latest additions to the FlareX ecosystem.

FlareFarm

FlareFarm is the ecosystem’s yield farming and fair launch distribution platform (launchpad). The platform allows holders of various F-Asset and Liquidity Pool tokens to participate in governance, yield farming and fair launch distributions for new projects entering the Flare Network and/or Flare Finance Ecosystem. Its primary use case is to ensure our governance token is distributed fairly. Its secondary use case, which is profit driven, is to enter new projects into the ecosystem via DAO Launchpads for a set fee.

If another project decides to utilize our launchpad to launch their token and distribute it to the holders of the Flare Network and Flare Finance Ecosystem, they can do so by creating a forum thread about their project and submitting a governance proposal to be added to the Launchpad. There are 2 fees associated with creating a Launchpad Proposal, a fee in YFLR (or YFIN) and a fee in the project’s token.

The fee in our tokens, which is established via governance proposal, is distributed in the following way:

50% is distributed to the APY Cloud for Governance Staking Rewards

30% is distributed to the Foundation for oversight of the Launchpad

20% is distributed to the Team and Investors as a Founders Fee

The fee in the projects token, which is established via governance proposal, is distributed in the following way:

50% is added as a Boosted Mining Period for Launchpad participants

30% is distributed to the Foundation for oversight of the Launchpad

20% is distributed to the Team and Investors as a Founders Fee

Once the platform initiates the launchpad, participants of the ecosystem can stake approved currencies to earn yield over an amount of time established by the project founders. Upon achieving a successful launchpad, the token is automatically listed on FlareX against FLR, YFLR, and CUSD.

FlareWrap

FlareWrap is the ecosystem’s Cross-Chain Asset Bridge. It will allow tokens hosted on other chains to be utilized on the Flare Network that would otherwise be inaccessible via the F-Assets Minting Platform. It also serves as the creation point for the CrossUSD (cUSD) Basketed Stable Coin. FlareWrap in its basic form bridges these assets and allows immediate usage on our product suite.

In its more advanced form, it allows for stable coin assets like Tether, USD Coin, and TerraUSD to be basketed to form CrossUSD (cUSD). CrossUSD is a basketed asset that maintains its peg closer to the relative underlying assets that collateralize it. CrossUSD maintains a more accurate dollar value by taking an average of the best available price of all underlying assets. Minting CrossUSD costs the same minting and burning fees as bridging other assets on the network, plus the transaction fees to complete the contract executions. The fee for minting and burning transactions is variable and established by governance. The distribution of this fee is as follows:

50% is distributed to the APY Cloud for Governance Staking Rewards

50% is distributed to the Team and Investors as a Founders Fee

FlareLoans

FlareLoans is the ecosystem’s peer-to-peer decentralized loans platform. It allows holders of approved tokens to lend and borrow against their assets to earn yield in the form of repaid loans and yield distributions (YFIN and other F-Assets). The cost to borrow and the yield earned on borrowing depends on the current market health and status of loan repayments. FlareLoans takes a variable fee established by governance on the amount borrowed and repaid. This fee is distributed as follows:

90% of this fee is distributed back to the FlareLoans Staking Pool

8% of this fee is distributed to the Team and Investors Pool

2% of this fee is distributed to the APY Cloud for Governance Staking Rewards

The amount one can borrow is established by the amount of total value locked in the staking pool by the borrower. This collateralization ratio is governance established and allows the borrower to borrow up to this ratio without fear of immediate liquidation. In the event that the underlying asset untethers from the needed ratio, the underlying assets will be liquidated to cover the loan. Yield on this platform is paid in the form of the underlying assets, as well as $YFIN.

FlareMutual

FlareMutual is the ecosystem’s peer-to-peer insurance mutual fund, based heavily on NexusMutual with modifications. It allows participants of its membership to purchase, or provide, coverage over assets, projects, smart contracts, agents, custodians, and more. FlareMutual utilizes a variable coverage fee that is established through governance, and part of this fee is distributed back to the APY Cloud and the Team. The fee is distributed as follows:

90% is distributed back to the FlareMutual Coverage Pool

8% of this fee is distributed to the Team and Investors Pool

2% of this fee is distributed to the APY Cloud for Governance Staking Rewards

FlareMine

FlareMine is the ecosystem’s yield mining platform. It allows PoW mining rig owners to mine Spark (FLR), Trustless BTC (FBTC), and Trustless LTC (FLLTC).

Miners contribute their hash power to a modified mining pool that mines PoW coins. The mining pool accomplishes one of two tasks based on user preference: 1.) Contributes these funds to a minting agent which produces $FBTC or $FLTC and distributes this to miners, or 2.) Converts the mined assets into $FLR at the best available rate. These assets are distributed back to the miners at a rate determined by their contribution to the pool’s total hash rate as well as their desired reward preference. This action results in $FLR price support, $FLR upward price motion, constant lock up of BTC and LTC assets into F-Assets, and a means to mine and deliver F-Assets directly to a users wallet.

The fee taken from these rewards is established by Governance. The fee is distributed as follows:

50% is distributed to the APY Cloud for Governance Staking Rewards

50% is distributed to the Team and Investors as a Founders Fee

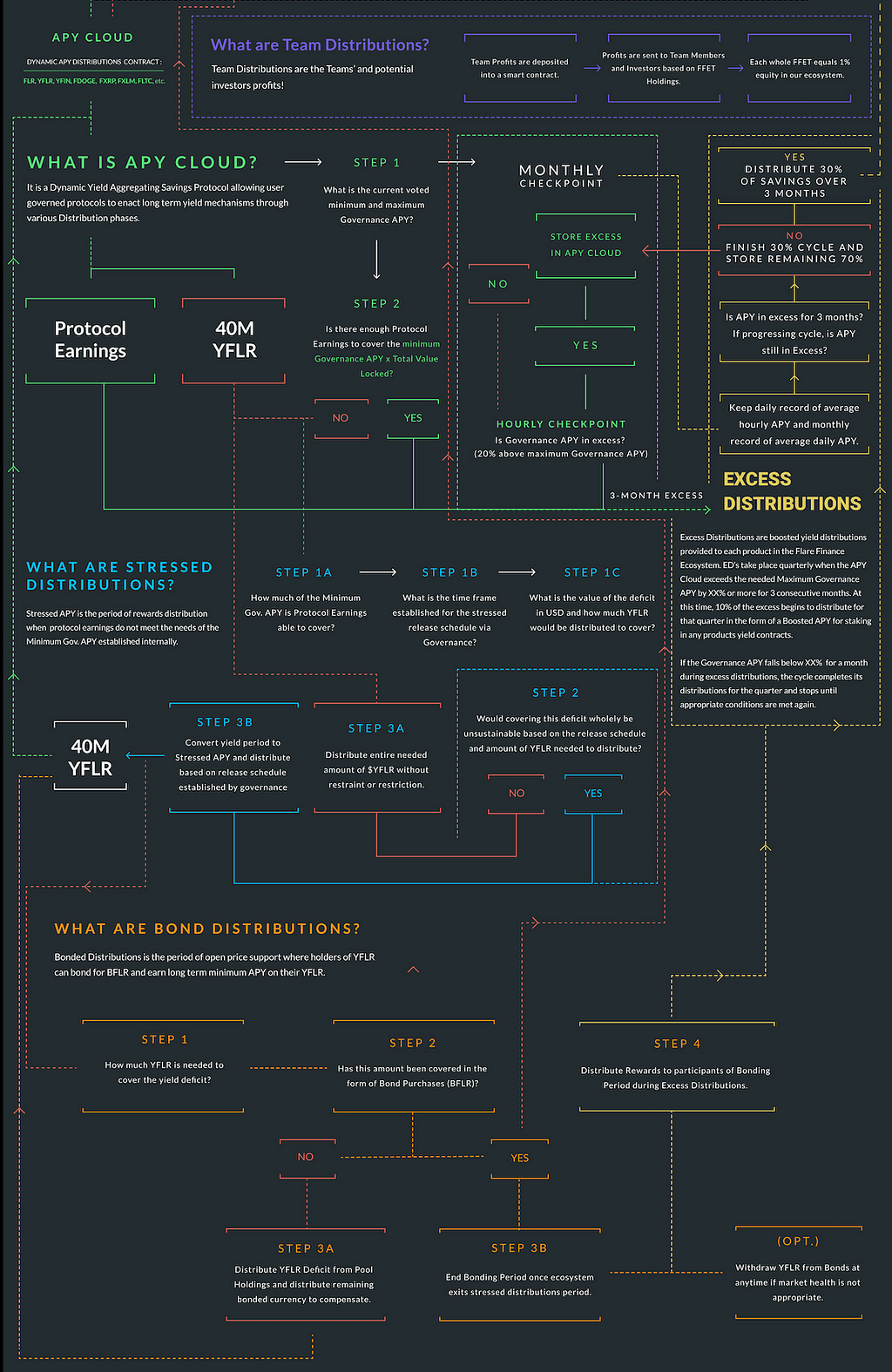

APY Cloud

APY Cloud is the first user governed dynamic yield aggregator allowing for long-term, sustainable yield platform wide. Additionally, APY Cloud creates a predictable minimum and maximum APY for long-term incentivized governance staking. With APY Cloud, participants of the Flare Finance ecosystem can rest assured that their long term yield goals can be met within reason by utilizing our product suite.

The problem with current DeFi suites offered to date is investors tend to be attracted to platforms with the most yield offered at the time. These APY % rates, sometimes in the high thousands, are almost always unsustainable and result in mining a token with little to no growth potential when planning for long term returns. While there is nothing wrong with High APY Rates, a means to maintain the value behind these distributions is necessary to protect the value of the investors total value locked. DeFi platforms should plan for the future and ultimately seek to provide a form of decentralized financial advisor for the user by promoting general long term financial principals known to all like saving and investing for the future.

With APY Cloud, we implement a truly substantial solution to this exact problem. APY Cloud is an intelligent yield aggregate savings protocol that helps the ecosystem remain in a healthy financial state by being the tokens personal “financial advisor”. APY Cloud completes a 3-step procedure when deciding how to react to the current and future outlook of the financial ecosystem, and accomplishes these steps to better adjust and support the holders token value. The steps to this procedure are:

Step 1 — What is the current voted Minimum Governance APY, Maximum Governance APY, and Excess Threshold?

First, APY Cloud decides what amount the Minimum Gov. APY and Maximum Gov. APY are set and adheres to these numbers. For this example, and for initial launch, these numbers will be set at a minimum of 5% and a maximum of 35%. Once APY Cloud has determined these numbers, it decides what the excess threshold is. For this example, and for initial launch, it will be 20% of the Maximum Gov. APY over itself. Once it has determined these three numbers it can move on to Step Two.

Minimum Gov. APY = Minimum APY Earned for Governance Staking (5%)

Maximum Gov. APY = Maximum APY Earned for Governance Staking (35%)

Excess APY Threshold = Max Percentage over Maximum APY before Savings Accrue (20% over = 7%)(Excess Threshold = 42%)

Step 2 — Is there enough Protocol Earnings to cover the Minimum Gov. APY x Total Value Locked?

Second, APY Cloud decides whether or not there is enough protocol earnings within its contracts to cover the required yield to be paid out to the Governance Pool. In this example, there will be $1,000,000 TVL locked in Governance Staking. With the Minimum Gov. APY of 5%, there would need to be $50,000 of Protocol Earnings to cover the Minimum Gov. APY and effectively pay Governance Staking Participants. Once APY Cloud determines how much Protocol Earnings it contains in comparison to this needed amount, it can proceed to make a decision.

Step 3A — No, there are not enough Protocol Earnings to cover the Minimum Gov. APY required for distribution!

Since there is not enough Protocol Earnings to cover the set Minimum Gov. APY the platform will calculate the dollar value needed to match the yield deficit and distribute the appropriate amount of $YFLR from the APY Cloud to match this deficit with the available Protocol Earnings.

In the event there is minimal protocol earnings, the platform configures each block reward to distribute $YFLR on a timed release schedule established by governance, in this example it will be 1/94,608,000 (3 years in seconds). This time release is initiated if the conditions are met by estimating if the amount to be distributed for that yield period (each block) exceeds the Sustainable APY Term creating a Stressed Distributions Period from then on and enabling Bond Distributions.

Step 3B — Yes, there are enough Protocol Earnings to cover the Minimum Gov. APY required for distribution!

Since there are enough Protocol Earnings to cover the set Minimum Gov. APY the platform will distribute all available Protocol Earnings continuously until these earnings either exceed the Excess APY Threshold (Step 1) or induce a Stressed Distributions Period (Step 3A) by falling below the Minimum Gov. APY.

In the event there is an abundance of protocol earnings, and the Excess APY Threshold is exceeded, there is a fair distributions mechanism in place to help ensure long-term yield potential for holders and platform users. This fair distributions mechanism is called Excess, Stressed, or Bond Distributions; or ESBD for short. ESBD is the period of varied yield distributions that is enacted to adapt to the current financial ecosystem produced by its participants. This can be visualized partially in this diagram, and further detailed in the next topic.

Excess, Stressed, and Bond Distributions

ESB Distributions Protocol

ESB Distributions is the first yield reaction protocol allowing for long-term sustainable yield distributions with conditional boosted rewards periods. These conditions are based on economically sound distribution principals creating a means to reward platform participation and long term user engagement without sacrificing protocol earnings potential or inducing a long term token value depreciation.

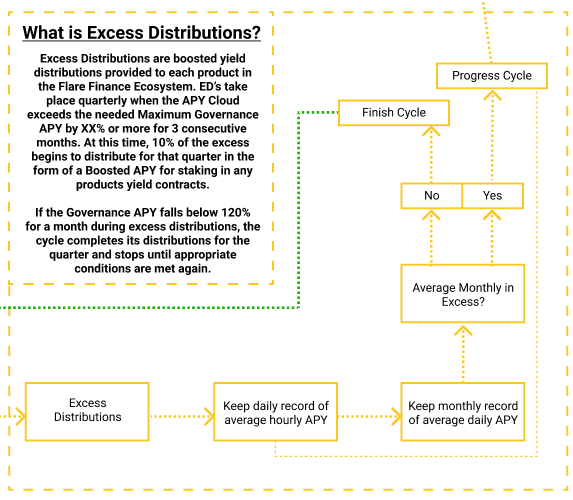

Excess Distributions

Excess Distributions take place quarterly when platform earnings exceed the Excess APY Threshold (Page 5) for more than 3 consecutive months. At this time, 10% of the saved excess is distributed for that quarter in the form of additional yield added to each products’ rewards pool. This distribution continues for as long as the platform earnings continue to exceed the Excess APY Threshold, providing more savings to the APY Cloud (Thus sustaining the Excess Distributions). If the average governance APY falls below the Excess APY Threshold for that month, the cycle completes distributions for the quarter and stops until appropriate conditions are met again.

Average Governance APY is calculated by APY Cloud keeping daily record of average hourly APY, then keeping monthly record of the average daily APY. If this number continues to produce an excess, the APY Cloud continues to produce another cycle of Excess Distributions. If the Average Governance APY falls below during any of the 3 months within the distribution cycle, it will complete that cycle and wait for 3 more consecutive months of platform earnings exceeding the Excess APY Threshold.

Each month during the three-month Excess Distributions cycle 10% of the accrued savings is distributed. This distribution allocation ratio is established through governance proposals. These proposals decide how much goes to each of the yield contracts for the 4 products in the ecosystem that distribute yield for staking or providing liquidity; FlareX, FlareFarm, FlareLoans, and FlareMutual. The end result is a sustainable yield protocol in optimum conditions that can survive the most crucial downturns of the market.

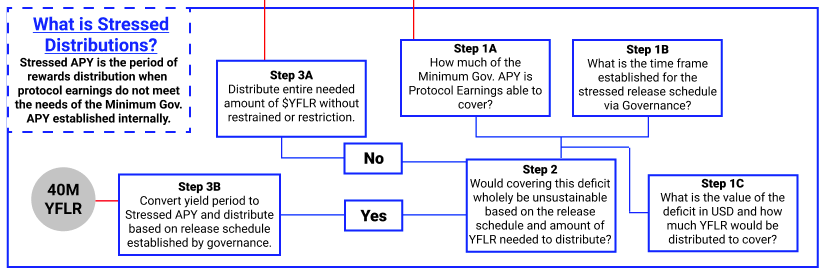

Stressed Distributions

Stressed Distributions are enacted when the platform begins to underperform and becomes unable to supply the Minimum Gov. APY established by its participants through protocol earnings alone. Stressed Distributions are a means of limiting output during a down cycle while still generating rewards for its participants at a bare minimum.

During Stressed Distributions, time supersedes necessary yield. What this means is, in the previous examples we established a time period of 3 years that the reserved YFLR Pool of 40M must distribute over from any given point of operation, meaning that for each distribution, it calculates if the next distribution will take it outside of, or back inside of, the desired time schedule to maintain a 3 year token distribution in the event of a long-term usage downtown. For every block distribution, APY Cloud will determine if the released amount is more or less than the desired time release schedule while also determining if the amount covers the deficit between platform earnings and Minimum Gov. APY needed to distribute to TVL. If this amount breaks the 3 year token distribution cycle, it will only distribute up to 1/94,608,000 of total Pool Value per block to maintain the cycle. If this amount does not break the 2 year cycle, it will distribute the entire needed amount to cover the deficit.

Stressed Distributions enacts a way to provide considerably reasonable APY during the worst conditions, while also incentivizing recovery through the use of Bonded Distributions. Bond Distributions is the final partition to the APY Cloud and will be explained in the next sub-topic. All of which makes delivering an all in one yield aggregating savings protocol that is adaptable to most situations thrown at it possible.

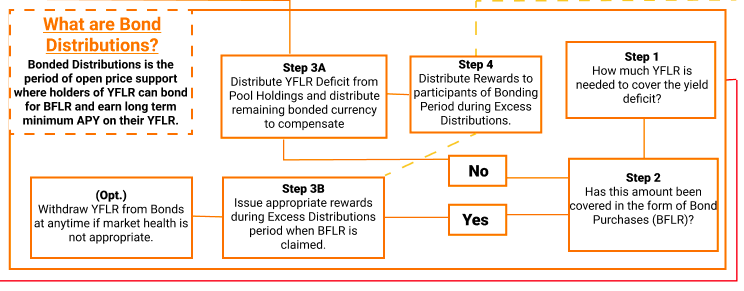

Bond Distributions

Bond Distributions is a period of open price support during Stressed Distributions where holders of YFLR can purchase Bonds at a 1:1 ratio for their YFLR locking in both a continued allocation of YFLR Governance Yield and a guaranteed minimum interest in the event of Protocol Earnings picking back up and issuing an Excess Distribution. This effectively creates a means to promote price support and ecosystem activity by reducing circulating supply indefinitely until activity and value return to the ecosystem to push it into an Excess Distributions phase.

As described in “Stressed Distributions’’ above, during a period of low Protocol Earnings, yield distributions cover the Protocol Earnings deficit in the form of YFLR from the Governance Staking Pool at a rate pre-determined by Governance. This rate establishes a maximum amount that can be distributed per rewards period to sustain the minimum time frame permitted under the established timed release schedule. This amount is covered by the 40M YFLR Reserved in the Governance Staking Pool, but ultimately could result in the entire staking pool being depleted if not for Stressed Distributions and Bond Distributions.

Bond Distributions take place between the time Stressed Distributions begin and end. That period of time in between is called the “Bonding Period”. During this time, holders of YFLR that are participating in Governance Staking can choose to opt in to the Bonding Period with their staked tokens. Their YFLR is locked indefinitely into the Bonding Contract, providing the holder with a 1:1 peg of BondFlare, or BFLR, for every YFLR they bond. Bonds are a representation of YFLR governance staking rewards, token appreciation, and bonding rewards. To claim bonds and exchange it back into YFLR, a holder of a bond simply opts out of the Bonding Period and begins this unlocking period at any point in time. This unlocking period lasts 7 days, but can be reduced or extended via Governance Proposals. Bonds are, in theory, YFLR indefinitely removed from circulation until converted back into YFLR either before or after the rewards period.

Bond Distributions enable the ecosystem to sustain itself during periods of lesser usage. While traditional treasury yield bonds have a set maturity rate usually between 5 and 10 years, Flare Finance Bonds do not have a set maturity rate. While bonding can only take place during Stressed Distributions, claiming these bonds can take place at any time, allowing the holder of the bond to determine their desired maturity rate and overall profitable outcome. There are three outcomes of purchasing a bond during the bonding period:

1. After Purchasing the bond, the market rises. Users gain value based on token appreciation, but exit before Excess Distributions, resulting in only gaining token appreciation and Governance Staking Rewards.

2. After Purchasing the bond, the market rises. Users gain value based on token appreciation, and you allow Excess Distributions to run until it fulfills its cycles, resulting in gaining token appreciation, governance staking rewards, and your share of the Excess Distributions allocated to participants in the Bonding Period.

3. After Purchasing the bond, the market falls. Value may be lost to token depreciation, but users are able to claim at any time to exit the market.

Participating in the Bonding Period does not remove the ability for the governance staker to earn their Governance Staking Rewards. These rewards are accrued regularly and can be claimed at any time just as if you had not participated in the Bonding Period. The indefinite time frame for the bonds comes from the need to achieve Excess Distributions before rewards are distributed to Bonding Participants. This means that bonds are a high risk to high reward products providing the ecosystem with a last resort fail safe by incentivizing removal of supply from circulation in hopes of creating a supply squeeze while demand is still present. In the event the Bonding Period is successful, and the platform achieves Excess Distributions, bond holders will automatically begin to accrue additional rewards in Governance Staking without any need for further action. Their bond will remain locked until the end of Excess Distributions, at which point, the bonds are claimed automatically. Rewards can be claimed at any time during this period and are not limited to claiming at the end of Excess Distributions.

In the event a user decides to claim Bonds after the Bonding Period, but before Excess Distributions, they will NOT receive any form of reward during the Excess Distributions cycle. They will instead only be entitled to token appreciation and Governance Staking Rewards. They will receive 1:1 return of their YFLR along with all Governance Staking Rewards earned. In the event a user decides to claim their Bonds during the Excess Distributions Period, but before it ends and automatically claims these bonds, the user will only earn the distributions up until the point of claim and none beyond the last day of the unlocking period.

Conclusion

The Flare Finance Ecosystem is a robust decentralized application designed to expand on the future potential of the Flare Network and provide a ecosystem full of sustenance and a means to deliver a true foundation for decentralized finance in it’s future stages. APY Cloud creates endless potential for ecosystem wide growth and helps ensure that the long term vision of the Flare Finance ecosystem can come to fruition through simple user engagement and precise execution.

This information will be further detailed in our upcoming Financial Paper release, and then broken down into code for you all in our Technical Documentation. Some time after launch, you all can expect this information packaged nicely into the first ever Flare Finance White Paper Release.