Remittance flows are one of the strong determinants of the overall economic health of low and middle-income countries, as they make up a significant part of financial inflows. Today, 800 million people are dependent on remittances to sustain their livelihood globally. Their vital importance is undebatable.

However, remittance companies are bound to use today’s correspondent banking model, where one ‘correspondent’ bank holds deposits owned by other ‘respondent’ banks and provides payment and other services to those respondents. Although this model has been an essential component of the international payments industry, it doesn’t comply with today’s fast-paced nature of cross-border payments, global trade, and e-commerce.

In correspondent banking, the only way to achieve instant transactions as needed is that the traditional payments industry players prefund their treasuries locally with their partners. Today, $4 trillion USD is locked in prefunding at any given time since regulators mostly prohibit the funds to be used for purposes other than its intended activity.

In the current financial system, prefunding operates as a ‘patch’ to overcome the shortcomings of the correspondent banking networks and settlement speed varies from 1–7 days. However, prefunding creates even more problems in the system as it entails high capital requirements, high FX exposure, and increased financial and treasury operations because cross-border payments are dependent on the networks such as SWIFT. Especially when there are long settlement cycles, prefunded capital acts as a barrier to growth in volume and to new corridors.

Arf comes up with a simple but cutting-edge solution to solve the need for prefunding in cross-border money transactions.

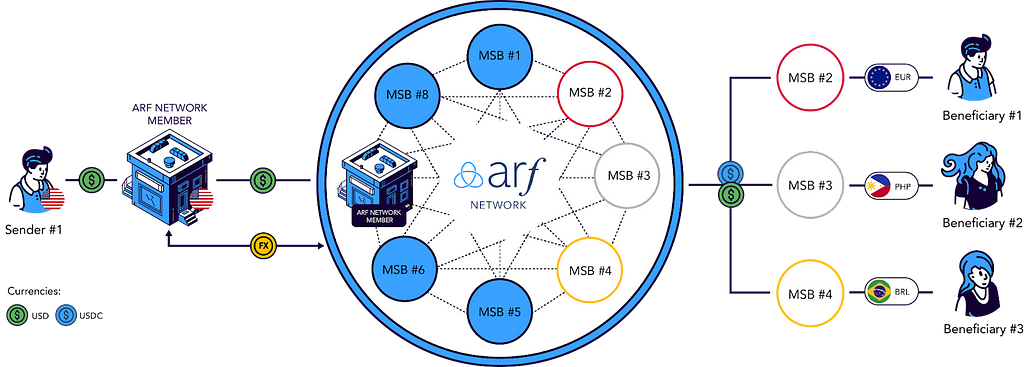

Together with Stellar, Arf brings an opportunity for licensed money service businesses (MSBs) and international money transfer operators (MTOs) worldwide to free themselves from high-capital prefunding requirements and conveniently build cross-border payment corridors. By leveraging stablecoins and allowing instant stablecoin settlements across multiple channels, including real-time transfers to bank accounts, e-wallets, and cash pickup points, Arf enables MSBs to build API-based cross-border financial operations and treasury management.

Arf provides “global treasury accounts” on stablecoins along with its cross-border instant settlement network to minimize the prefunding need in each corridor partner’s bank account. With the combination of both, an MSB can send and receive payments from other MSBs in the network and hold its treasury denominated in USDC. On average, the prefunding need per corridor goes from 50% to 80% if the number of corridors utilized multiplies per MSB.

Moreover, Arf recently launched Arf Credit, providing API-based, transactional, short-term working capital credit line to MSBs and reduce prefunding requirements in its network down to zero percent.

Another benefit of using Arf Network is significantly lowering FX exposure with instant settlements by providing API-based, real-time, and local FX rates. An estimated 1/3 of managed prefunding in local currencies in a year is lost due to currency fluctuations, lack of real-time FX services, or regulations that prohibit holding prefunding in foreign currencies (depending on the country.)

For this to work, Arf handles all the legal and compliance aspects, pricing, and FX via its API and dashboard. This way, MSBs as part of Arf Network from all around the world continue business as usual in fiat while settling between themselves in USDC.

The key differences between Arf and other fiat or crypto-based networks are:

- Arf provides a fully compliant network.

- Any member can connect to all corridors inside Arf Network via a single API and a single Agreement.

- First and last miles can be in fiat so end-users and businesses don’t have to understand the concept of stablecoins or blockchain.

- Value (money) is settled instantly along with the payment and compliance information.

- Arf works only with attested, audited, fiat-backed stablecoins which are always 1:1 in value, like USDC.

Arf is positioned as a stablecoin treasury provider to licensed financial institutions (FIs) and money service businesses (MSBs) along with its instant local settlement network. With the support of the Stellar Development Foundation (SDF), Arf helps MSBs to easily connect to each other, allowing them to significantly reduce the overhead of implementing APIs by leveraging Stellar Protocols as a standard for blockchain transactions. In addition to the treasury services, Arf provides MSBs cutting-edge financial instruments via 1:1 fiat-backed stablecoins, such as transactional credit line, and compliant DeFi high-yield accounts. As of March 2022, Arf is live in more than 60 countries including the US, UK, Singapore, and China, with more than 150 MSBs in the pipeline.

How Arf made payments simple and easy for remittance companies

Demand for money transfers increased from Europe to the Philippines. As of 2020, remittance flows reportedly made up almost 10% of the Philippines’ GDP, indicating an opportunity to enhance the experience for both sides of money transfers. As a result, digital MSB based in Europe and Arf launched a payment corridor between Europe and the Philippines.

Case Study

A babysitter living in Europe downloads the remittance app, approves the quote, and instantly sends the money back to her family in the Philippines.

In the background of this transaction, the app sends the required amount of euros to the ‘global treasury account’ provided by Arf. This amount is transferred to an Arf Network Member in the Philippines through Arf’s stablecoin infrastructure.

The member instantly pays out the money in Philippine pesos by using its own payout channels such as bank accounts, e-wallets, and cash pickup points. End-users and businesses never have to understand or deal with any stablecoins, as the payout always happens in fiat.

The transaction, including the USDC amount, FX, and KYC information flows, is seamlessly orchestrated by Arf’s technology. It only takes a few minutes for the transaction to settle in the beneficiary’s local account.

In this way, the remittance company keeps the treasury in the global treasury account to make instant payments, minimizing its financial operations and regular capital requirement. Most importantly, the same account can be used for all of the corridors and payout channels supported by Arf Network without additional effort.

Download the case study.

About Arf:

Arf, a VISA Innovation Program company, built a global payment network enabling instant and fully compliant fiat-to-fiat cross-border payments by leveraging regulated stablecoins for licensed money service businesses (MSBs), especially e-wallets, neobanks, FX providers, digital remittance companies, and payment companies. Arf enables MSBs to build API-based cross-border financial operations and treasury management. https://arf.one/

How Arf helps increase remittance flows by using the Stellar network was originally published in Stellar Community on Medium, where people are continuing the conversation by highlighting and responding to this story.