The Reserve Bank of India recently announced on July 19, 2022 that they are deploying blockchain technology for smoother payments across borders. They proceed to follow up with some statements that that suspiciously sound like RippleNet and XRP could be involved. This is not confirmed information but we are speculating that this may be the case considering RBI is partnered with 3 Ripple-enabled banks (Axis Bank, Yes Bank, & Kotak Mahindra).

“The product is based on open-source blockchain technology and will allow the parties involved to keep track of any transaction at every stage”

“…when the payment is happening there is also a ledger that records where the payment is at every point in time.” (source)

“Open is a technology platform – it is not a bank and does not hold or claim to hold a banking license. The business current accounts, VISA corporate cards, business loans and other similar banking services/financial services offered on the Open platform are provided by RBI-licensed banks and financial institutions. All funds in the Open powered business current account are insured as per limits prescribed under the RBI’s deposit insurance scheme. The banking services/financial services offered on the Open platform are powered by our partner banks/financial institutions and follows all security standards and legal requirements prescribed by the partner bank/financial institution, in accordance with extant RBI regulations”

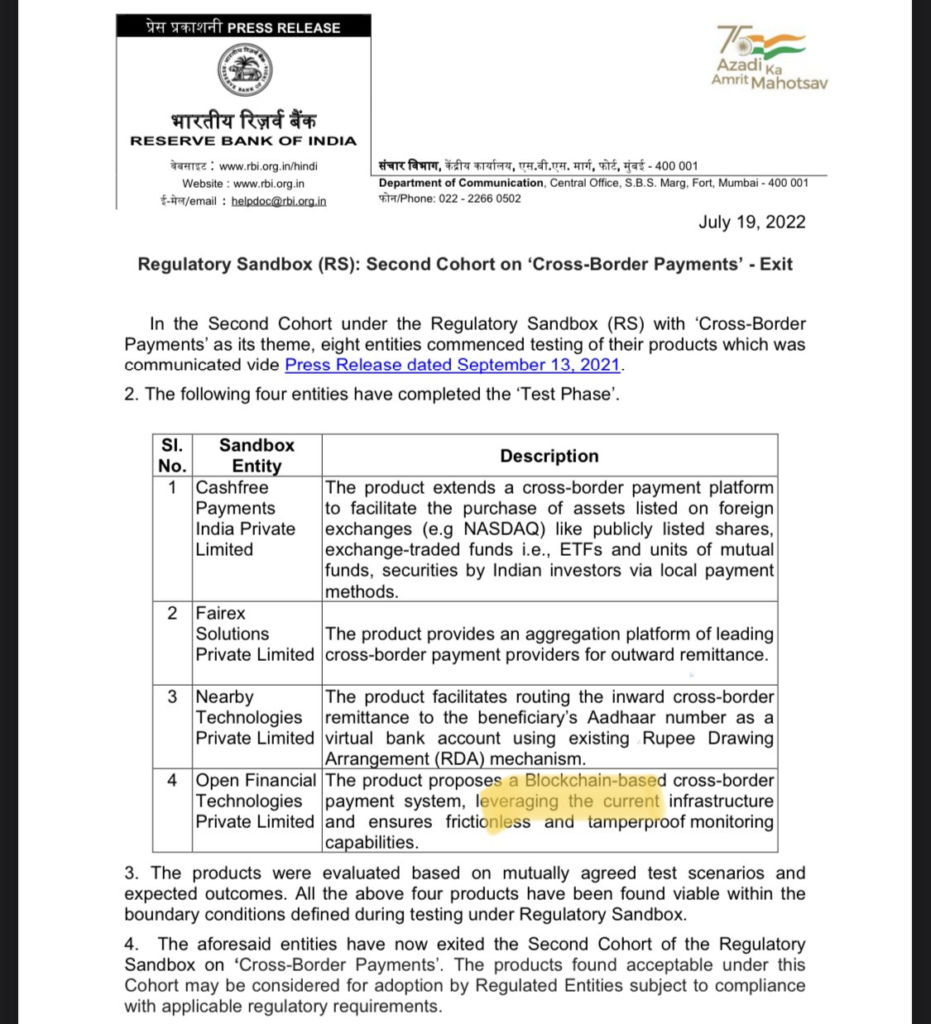

You also may want to take a look at this Reserve Bank of India official press release document, which again, suspiciously starts to sound a lot like RippleNet/XRP usage.

We must note that the “frictionless” is a term very commonly used by Ripple when explaining why XRP is a better solution than the current modern day international payment system SWIFT”. It’s interesting to see the same phrase being used by the central bank of India, when announcing usage of a blockchain-based system that involves a ledger. As we know, Ripple has been working with many central banks for quite a long time, and this is a proven fact. in 2018 a Ripple member stated publicly that they were actively working with 40-50 central banks. A lot of time has passed since then, wouldn’t be a surprise if major developments in India are currently underway.

Perhaps this could explain Ripple recently acquiring $1.7B in XRP in Q2 2022, for that large of an acquisition something serious must be going on behind the scenes. In our opinion Q2 2022 was not a regular quarter for Ripple.

(Credit for information discovery: @MatthewLINY)

The post India Central Bank Deploying Blockchain Technology… With Confirmed RippleNet Partners appeared first on The XRP Daily.