Trust Score Explained

In traditional markets, exchanges with high volume equate to high liquidity. However, in crypto markets, exchanges with high volume does not necessarily equate to high liquidity. This is because many of the unregulated exchanges engage in wash trading and other manipulative behaviors to inflate their trading volume.

As one of the leading cryptoasset data aggregators, CoinGecko is committed to doing what’s necessary to empower our users with information to help make better-informed decisions. We are fully aware that the market demands transparency and CoinGecko is committed to improving this.

To combat fake exchange volume data, we’ve developed our rating algorithm called “Trust Score.” Ever since its inception in May 2019, we’ve successfully revamped all rankings of our own and subsequently led the upgrade industry-wide to start measuring by liquidity rather than reported numbers.

On CoinGecko, trading pairs and exchanges are no longer ranked as they are reported, but rather ranked more holistically based on various related metrics and we packaged it all as Trust Score to make it actionable at one glance.

Trust Score measures many facets of what an actively trading cryptocurrency or cryptocurrency exchange should have – namely liquidity, trading activity, scale, technical expertise and more. In 2019, we rolled out Trust Score in two separate releases:

• Trust Score 1 (May 2019) – ranks trading pairs based on web traffic, liquidity & trading activity related metrics.

• Trust Score 2 (Sep 2019) – ranks exchanges based on web traffic, liquidity, scale & API coverage.

Breaking it down

“What is Trust Score?” is something we get a lot, so we’ve decided to write this article that focuses on explaining it without any technical details. This article will help to easily understand what Trust Score is. If you’re looking for the technical details, feel free to take a look at our previous posts covering the release of Trust Score 1 and Trust Score 2.

As mentioned previously, Trust Score measures trading pairs and crypto exchanges, and here’s a breakdown of what they take into account for each:

|

Measurement/Metric |

Trading Pairs |

|

|

Reported trading volume |

✓ |

✓ |

|

Reported orderbook data (depth & spread) |

✓ |

✓ |

|

Web traffic statistics by SimilarWeb |

✓ |

✓ |

|

Overall trading activity |

✓ |

✓ |

|

Exchange’s scale of operations |

✕ |

✓ |

|

Exchange’s API technical coverage |

✕ |

✓ |

We’ll split the next sections between trading pairs & crypto exchanges to help you visualize what’s changed since Trust Score. Let’s get started!

Trading Pair Ranking

Trading pairs refer to the sets of trading combinations that can be done through a crypto exchange for a given cryptocurrency.

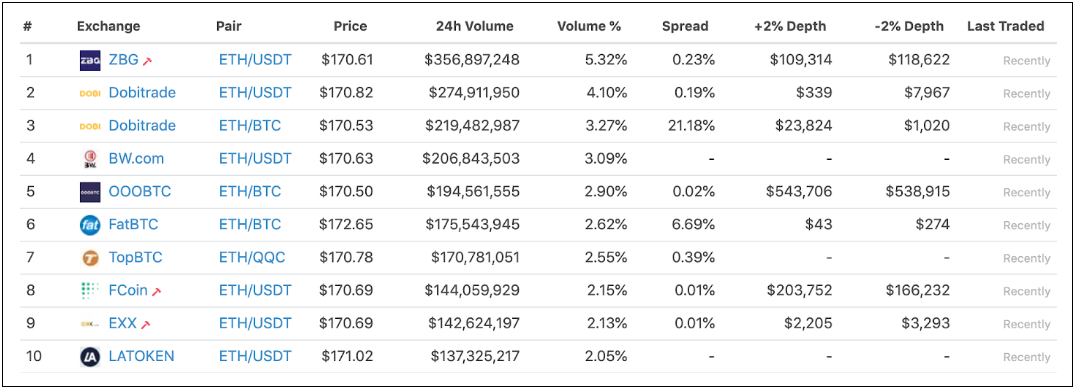

Prior to having Trust Score, trading pairs were ranked purely based on reported 24h volume, and that made it prone to manipulation as it was easy to over-report, and difficult to verify. Here’s an example of what the highest ranked trading pairs looked like back in the days:

Ethereum (ETH) Trading Pairs (May 2019)

Ethereum (ETH) Trading Pairs (May 2019)

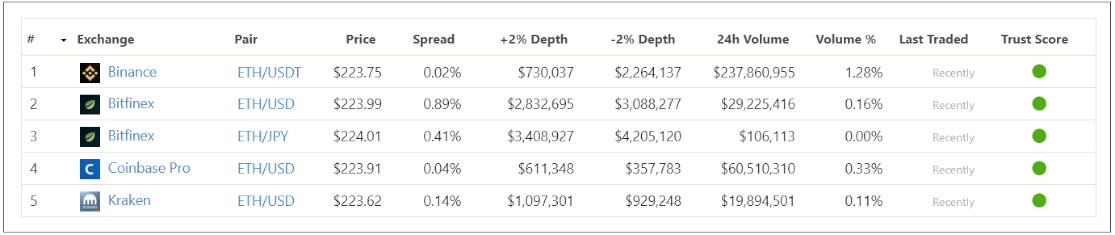

Using Trust Score, we now rank trading pairs using a combination of reported volume, order book depth, order book spread, an exchange’s overall web traffic quality, as well as trading activity. This makes for a more comprehensive ranking that better reflects the overall liquidity a trading pair has, and arguably much more difficult to manipulate.

Here’s how trading pairs for Ethereum (ETH) looks like after Trust Score was implemented – overall liquidity became the yardstick, rather than trading volume alone:

Ethereum (ETH) Trading pairs (Feb 2020)

Ethereum (ETH) Trading pairs (Feb 2020)

Crypto Exchange Ranking

Crypto exchanges, similar to trading pairs, were also ranked based on their reported volumes. It worked in the earlier days but eventually became a meaningless number as they exchange race heated up and many sought ways to make themselves appear as the “top” exchange.

Through Trust Score, we once again refreshed the standards of crypto exchange ranking to rank them by various metrics, which can be generally classified into three different categories:

-

Liquidity/Web Traffic Quality – Reported volume, order book depth, order book spread, trading activity, as well as overall web traffic quality.

-

Scale of Operations – Measures an exchange’s overall trading volume, order book depth, order book spread and activity relative to the rest of the industry?

-

API technical coverage – Measures an exchange’s capability in terms of API availability & coverage

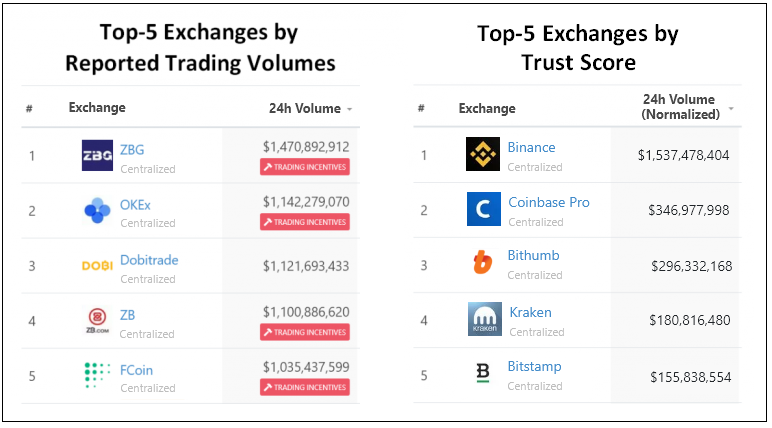

Through this, we’ve managed to completely change how exchanges are ranked on our site. Here’s an example of how it has changed on CoinGecko’s Exchange page:

Top-5 exchange sorted by Reported Volumes (May 2019) vs.

Top-5 exchange sorted by Reported Volumes (May 2019) vs.

Top-5 exchange sorted by Trust Score (Feb 2020)

Will there be more changes to Trust Score?

In short, yes. We will be constantly revising, improving and upgrading Trust Score as we learn lessons through implementation and from the feedback of our beloved community along the way. In the near future, we are also looking to incorporate more dimensions of measurement to make it more robust. Some of them are:

-

Trade history analysis

-

API quality analysis

-

Cybersecurity analysis

-

Hot & Cold wallet analysis

-

Social Media analysis

-

Exchange support turnover time

-

User Reviews

-

Licensing & Regulations

Closing Remarks

And that’s it! We hope this article sufficiently explains the concept of CoinGecko’s Trust Score. Once again, if you’d like to understand it in more depth, feel free to visit our other blog posts: Trust Score 1 and Trust Score 2.

The post Trust Score Explained appeared first on CoinGecko Blog.